nh meals tax payment

B Five cents for a charge between 38 and 50 inclusive. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

. Enter payments made in advance of the due date for the current tax period or for any Credit Memo you received from the Department. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars. Use the link on the left side of page Payment Options to make a payment on-line by credit card or e.

Years ending on or after December 31 2027 NH ID rate is 0. There is also a 85 tax on car rentals. The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations.

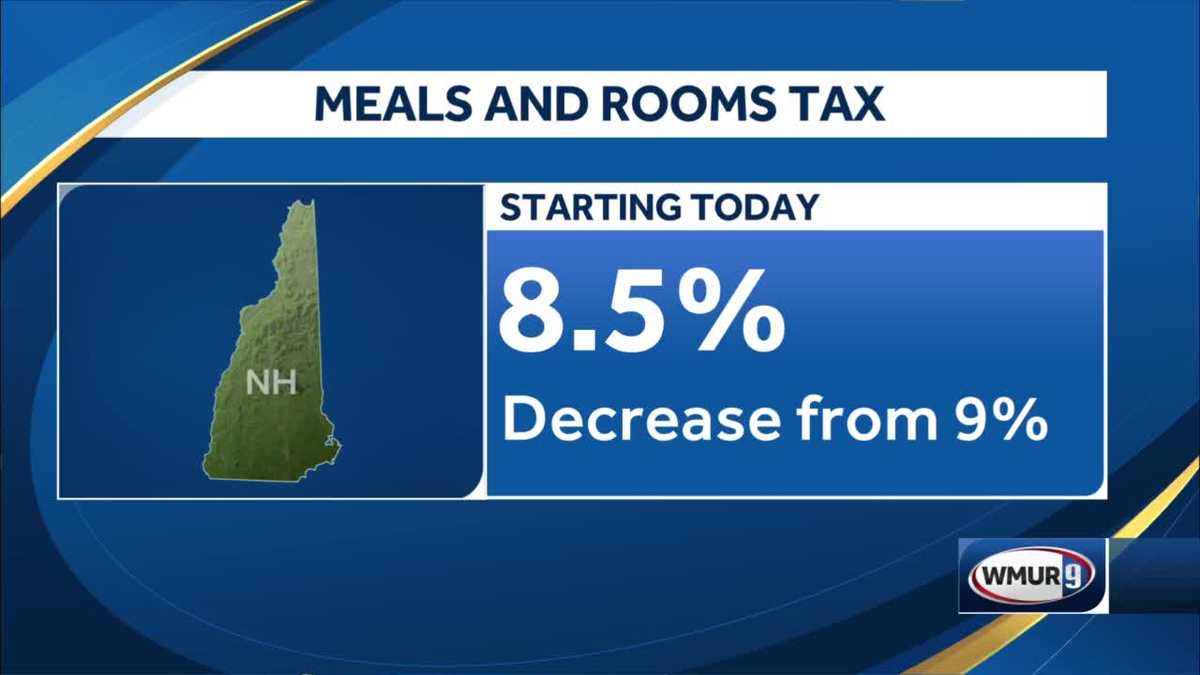

A Four cents for a charge between 36 and 37 inclusive. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

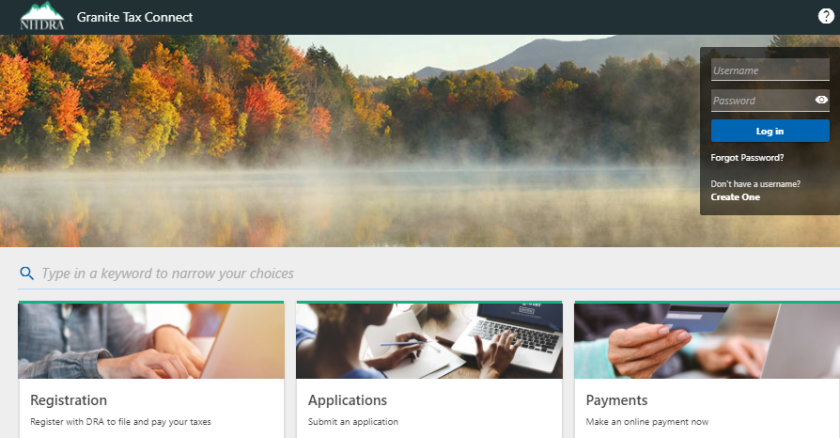

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. File and pay your Meals Rentals Tax online at GRANITE TAX.

October 1 2021. NEW HAMPSHIRE 2016 MEALS RENTALS TAX BOOKLET RSA 78-A - REV 700 This booklet contains the following New Hampshire state. The current tax on NH Rooms and Meals is currently 9.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. New Hampshire is one of the few states with no statewide sales tax. Exact tax amount may vary for different items.

New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. The awareness of the Meals Rentals Tax Operators legalstatutory responsibility as an agentoperator of the State of New Hampshire for the collection and monthly remittance of all Meals and Rentals Tax as well as the obligation to maintain records in conformance with RSA 78-A19 and the NH Code of Admin. New Hampshire Department of Revenue Administration.

603-271-3176 Hours of Operation. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate. Starting Friday the states tax on rooms and meals was reduced from 9 to 85.

603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022.

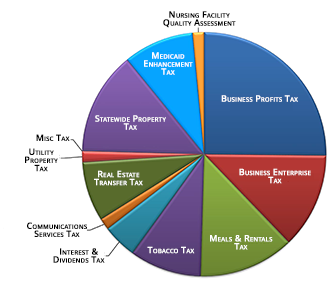

Meals and Rooms Tax Where The Money Comers From TransparentNH. Chris Sununu said towns and cities. A 9 tax is also assessed on motor vehicle rentals.

New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. PART Rev 701 DEFINITIONS. NH Meals and Rooms Tax.

The operator shall be responsible for the payment of the tax on the total amount of rent paid. CHAPTER Rev 700 MEALS AND RENTALS TAX. What is the Meals and Rooms Rentals Tax.

Find Out Today If You Qualify. Advance Child Tax Credits ACTC payments are early IRS payments from the 50 percent of the estimated amount of the Child Tax Credit that you may claim on. Tax Returns Payments to be Filed.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Tax Year 2021 April Filing Deadline for Interest Dividends and Business Tax Returns.

Be sure to visit our website at revenuenhgovGTC to create your account access today. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. A tax is imposed on taxable meals based upon the charge therefor as follows.

Home page to the New Hampshire Department of Revenue Administrations website. That means someone buying a 24 restaurant meal would pay 12 cents less. Meals and Rentals TaxRSA Chapter 78-A.

Interest is calculated on the balance of tax due from the original due date to the. For additional assistance please call the Department of Revenue Administration at 603 230-5920. Box 203989 Houston TX 77216-3989 Please mail the couponbottom portion of statement with your payment to avoid delay of payment posting.

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. Pay taxes and more. Document 6690 effective 2-21-98.

A tax of 85 percent of the rent is imposed upon each occupancy. Please visit GRANITE TAX CONNECT to create or access your existing account. Years ending on or after December 31 2024 NH ID rate is 4.

Please mail TAX PAYMENTS ONLY to the following address. Ethan Dewitt-New Hampshire Bulletin. Enter total deductions Line 13 plus Line 14.

603 230-5945 Contact the Webmaster. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forwardThe state meals and rooms tax is dropping from 9 to 85.

2022 New Hampshire state sales tax. Years ending on or after December 31 2026 NH ID rate is 2. Fillable PDF Document Number.

Years ending on or after December 31 2025 NH ID rate is 3. There are however several specific taxes levied on particular services or products. Paper returns in General Instructions of the Meals Rentals Tax Booklet LINE 14.

TIR 2021-004 2021 Legislative Session in. Multiply this amount by 09 9 and enter the result on Line 2. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Boston Area Leather Furniture Tax Free Nh Currier S Kitchen Lighting Over Table Window Seat Kitchen Home Decor

Historical New Hampshire Tax Policy Information Ballotpedia

Everywhere Kids Eat Free In Nh Kids Eat Free Eat Free Children Eating

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Mother S Day Menu Come Join Us With Your Family Make Your Reservations Here 603 778 3762 Fruit In Season Cold Meals Seasonal Salad

Pin By Cindy Brown On Fish In 2022

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Pin By Park Inn By Radisson Gurgaon B On Park Inn Radisson Bilaspur Happy Family Meals Food

Pin By Bellshomestead On Planning Our Homestead Food Protection Prepared Foods Things To Sell

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Revenue Dept Launches Final Phase Of Tax System

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Transparency Nh Department Of Revenue Administration

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

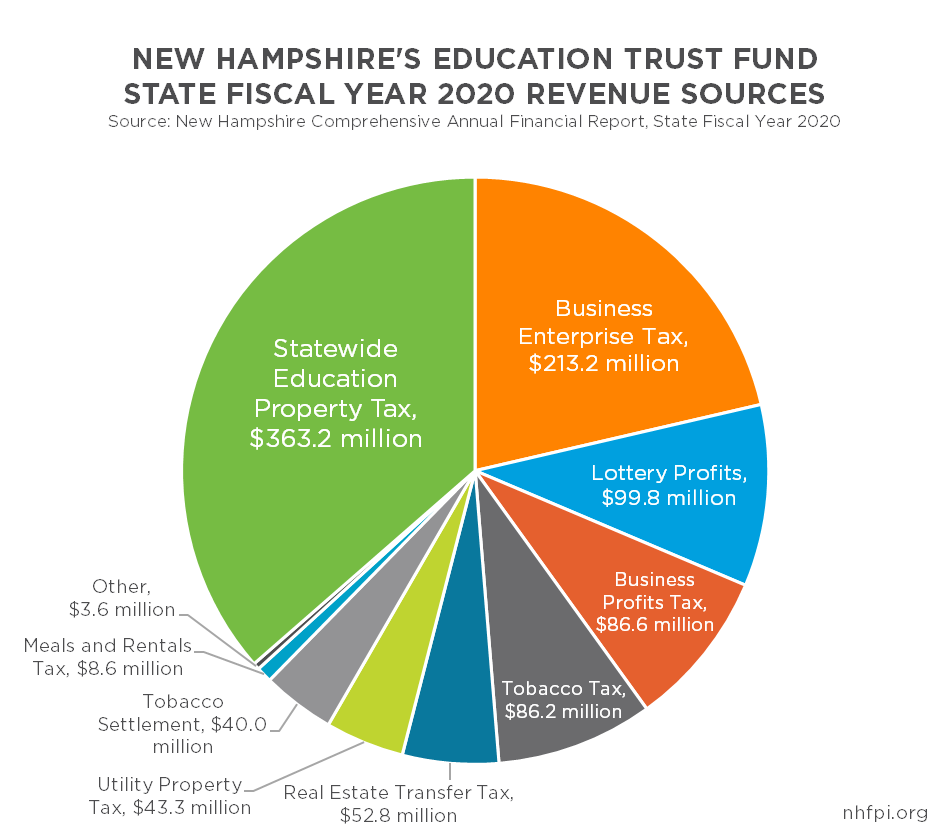

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

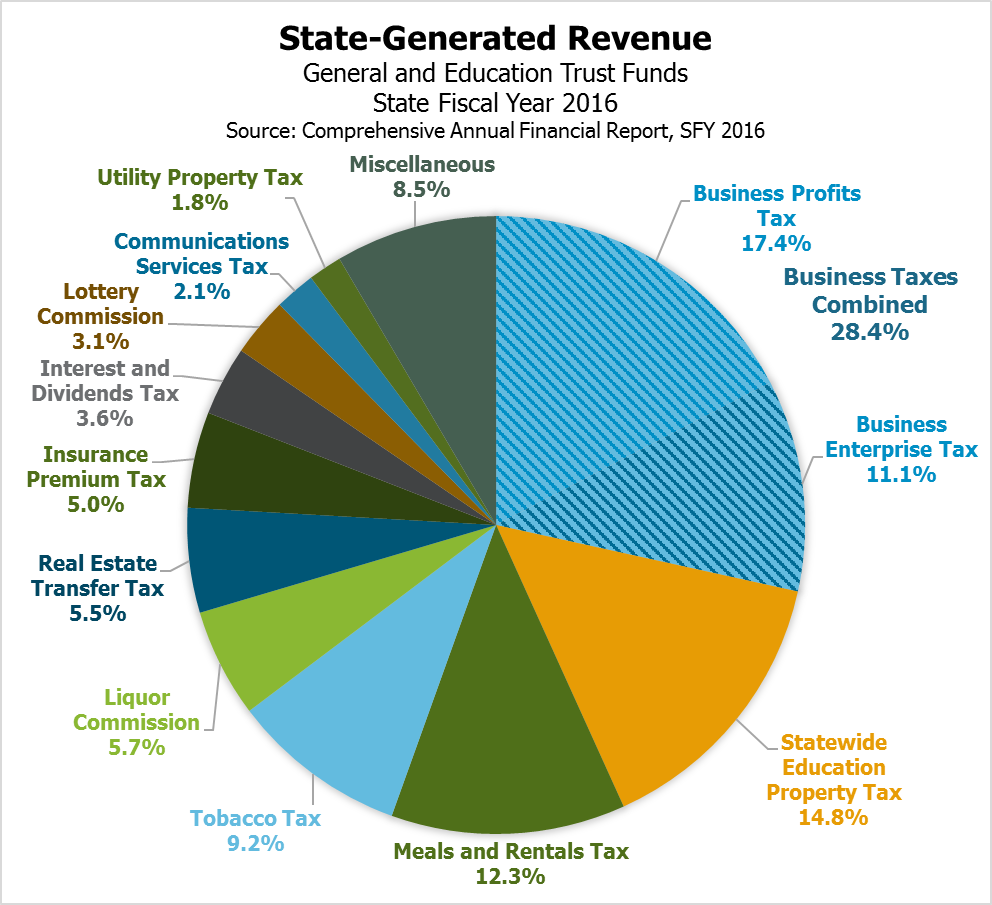

Revenue In Review An Overview Of New Hampshire S Tax System And Major Revenue Sources New Hampshire Fiscal Policy Institute